Home financing recast happens when you will be making a large one to-time payment to attenuate your own home loan equilibrium plus financial recalculates your own payment per month thus. (This can be also referred to as a re-amortization of one’s mortgage.) Your financial restructures the payment schedule for the rest of your loan label to help you be the cause of this new lump-share percentage.

Recasting the home loan will not replace your interest otherwise loan terminology however it will help reduce your needed minimum payment per month also it can help you save money inside the focus along side lifetime of your own mortgage.

Only a few loan providers promote recasting and never all mortgage systems was eligible. You could potentially will generate a swelling-share percentage to cut back the dominating harmony however, versus a great recast the monthly homeloan payment perform stand a similar.

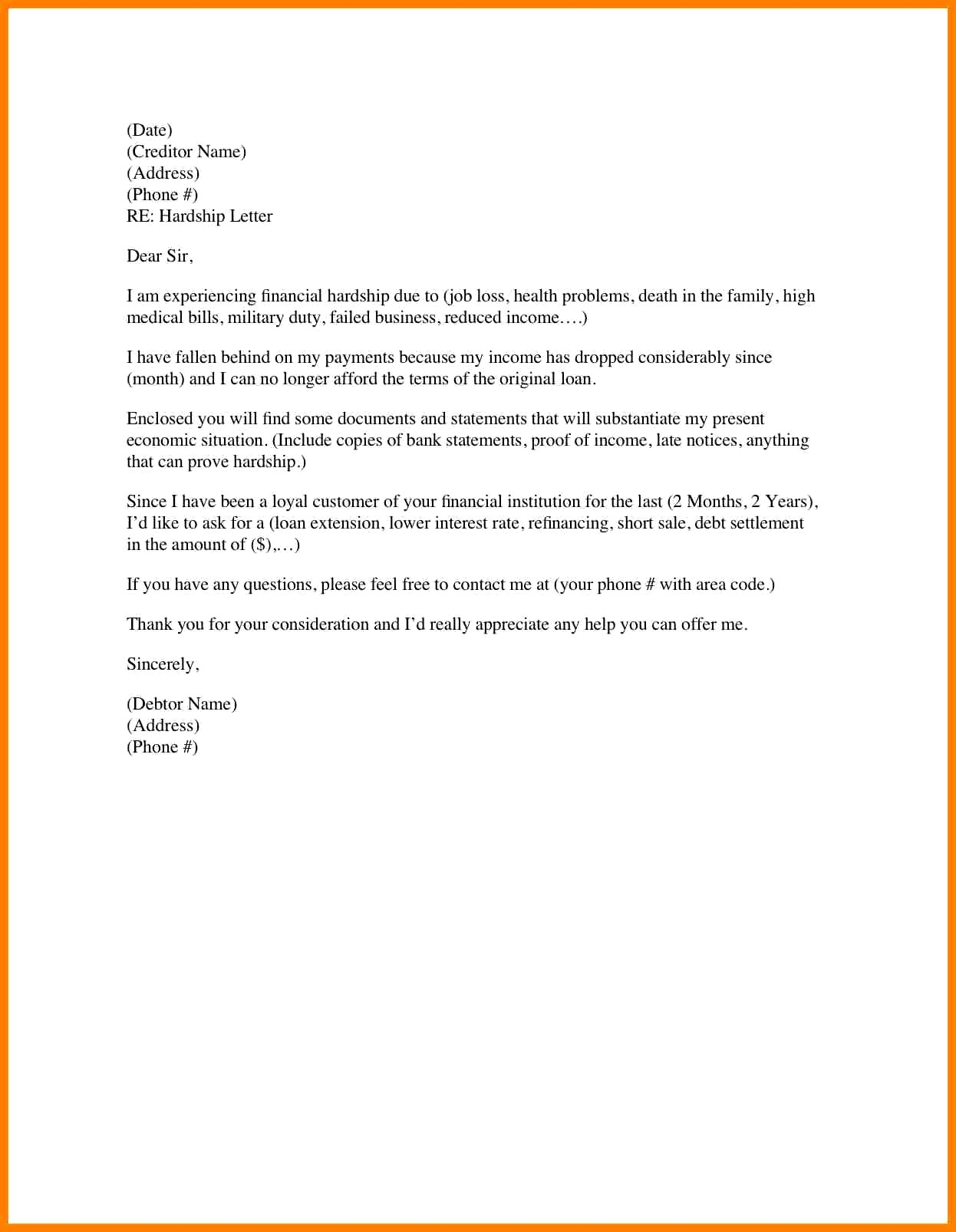

Mortgage recast analogy:

When determining whether to recast your mortgage, it’s often best to look at the number to determine in the event that its sensible. Check out this home loan recast example.

Contained in this example, this new debtor might possibly obtain bank to recast the mortgage and just have a unique straight down payment to possess principal and you may attract.

Would it be smart to recast the financial?

Recasting the home loan possess advantages and disadvantages. When you generate a big lump-share percentage generally speaking required for home loan recasting, you can decrease your payment and you can probably save money on appeal payments. And make a lump-sum payment form you won’t get that money readily available for issues or other costs, not.

And, you can also thought and come up with a lump-contribution payment one to reduces your dominating balance but not recast your mortgage and keep your payment a comparable. The main benefit of and also make a lump sum payment and you will looking after your monthly payment like opposed to recasting the borrowed funds is actually that the will get allows you to pay-off your own home loan smaller. By paying off your own financial shorter you are able to likely save your self alot more profit appeal over the life of the mortgage.

Any time you re-finance otherwise recast your financial?

Recasting and you can refinancing are one another choice that might help you all the way down the payment per month and spend less on notice. Recasting means one has actually a lot of dollars so you can build a-one-date commission and won’t allow you to improve your appeal rate or any other mortgage words, although not.

Refinancing gives you the ability to decrease your rate of interest and you will probably reduce your commission or reduce attention. Refinancing has no need for that provides a large amount of bucks while you will need to pay settlement costs while will need to satisfy their lender’s borrowing from the bank, income, and financial conditions to get your refinance acknowledged.

Consider one another solutions and decide which is the correct choice for your. Also keep in mind by the refinancing, the total money charge you have to pay is higher over the lifetime of the loan.

How often do you really recast your own home loan?

There was fundamentally maybe not a threshold to how often your is recast their financial, however, recasting your home loan typically includes a fee. So it payment will be several hundred or https://cashadvanceamerica.net/payday-loans-nd/ so dollars and must getting factored into the choice to recast. When you have already recast your own mortgage, you’re able to pay off their financial early because of the using your most coupons to blow down the financial dominating.

Recasting which have Versatility Mortgage

Are you presently a current Independence Home loan buyers having questions regarding if you are permitted recast their home loan? Virtual assistant, FHA, and USDA money aren’t eligible for recasting. Old-fashioned fund are qualified for individuals who satisfy the needs. Phone call our Support service Representatives at the 855-690-5900 to discuss recasting.