Economic Tips for H-1B Visa Holders Due to the EB-5 Investment

For almost all younger immigrant pros in the united states, brand new H-1B charge system merchandise a myriad of challenges and you can concerns. Due to the fact a financial coordinator specializing in this community, I appear to witness the anxiousness and you will frustrations stemming throughout the unpredictability of its immigration and you may a job updates. When they need certainly to changes perform or reduce their perform quickly, they have to select a separate boss who can mentor them and document an alternative H-1B petition, which can be high priced and you may go out-taking. Possibly, they may need to remain in reduced-investing otherwise abusive practices in order to continue their charge updates. There is also to manage brand new lotto program, the latest cap on the visas, the latest repeated rules alter, and also the prospective ripoff and you can discipline of the specific companies and intermediaries. Moreover, they ily people who are not qualified to receive a keen H-cuatro charge, including adult pupils and you can elderly mothers, that may trigger household members separation and emotional stress.

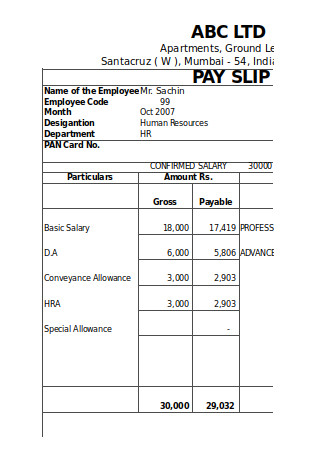

Into mediocre H-1B proprietor, that petition submitting is secure green notes towards investor, its lover, and you may people people created beyond your U.S. Thinking to own filing comes with securing $800,000 to your capital, an extra $fifty,000-$80,000 into the management and you may top-notch service can cost you, and you will ensuring every fund are well-noted by authoritative present. A keen EB-5 investment generally speaking will not pay buyers until immediately after half dozen to help you 7 age and this also was an enthusiastic at risk investment. Thus, I usually advise that immigrant dealers care for a financial back-up before making so it capital.

For H-1B proprietors seeking long lasting home regarding You.S, the fresh EB-5 charge towns zero standards towards the implementing, it is therefore best for individuals who want to prevent backlogs when you look at the the new EB-1 and you will EB-2 categories. Petitioners shouldn’t have to see English, keep any sort of unique honors, degree, really works sponsorships, or have an excellent show to utilize. Truly the only conditions expected try a complete, suffered capital from inside the a business enterprise, ten work which can be produced using your financing, and you may an appropriate supply of loans for the buyer and their nearest and dearest.

Within blog site below I detail a number of the preferred strategies my personal subscribers or other H1B holders generally financing their expenditures and you may what can be done now to begin with finding your way through it financing.

To navigate such economic demands, H-1B proprietors usually utilize the pursuing the options to finance the EB-5 Financial support

- Savings: High-generating advantages surviving in low-rates section can also be gather big coupons thanks to patient budgeting and disciplined investing designs.

- Advancing years Account: Individuals with large 401(k) stability could probably borrow on these fund because of an excellent 401(k) mortgage, to stop early withdrawal punishment and you may preserving senior years offers.

- Household Guarantee: Home owners having extreme collateral can potentially safe a home security line out of credit (HELOC) to finance their EB-5 financial support.

- Nonexempt Brokerage Levels: People that have substantial holdings for the carries or securities can envision a good securities-recognized line of credit (SB-LOC) to help you leverage the assets.

- Money from House Country: Income from assets or other assets throughout the investor’s domestic country can provide the required money for as long as there can be authoritative origin files offered.

- Presents from Family and friends: Noted gift suggestions away from family relations or friends normally subscribe to the new capital fund.

- Loans: USCIS permits EB-5 opportunities funded compliment of funds, provided brand new buyer assumes on only obligation to the loans and you can secures it which have private property unlike that from brand new money business. (Signature loans are payday loan online same day Wyoming an option too nevertheless would be most challenging discover highest signature loans.)

Getting ready for the future: A proactive Means

Begin by delivering certain of your targets: Defining it is important for your requirements will help bring clarity towards what you need to perform together with your currency. E.grams. If remaining in the world in the long term is more essential than just owning a home (for the short term) you will need to keep towards the some other accounts as opposed to purchasing a property.

You to clear step: Take a seat which have an article of papers and you can number what you need to reach in 1, step 3 and you may five years out of today. Reorder these regarding most important to help you minimum extremely important.

Speed up coupons + Aware using: I dislike the phrase budget since it keeps a bad connotation, so i instead recommend that somebody spend much more awareness of their expenses. You really need to speed up money course in a manner that with each paycheck you send currency into the an economy/funding account and spend the other individuals in a way that aligns along with your philosophy.

You to clear action: Start one which just are ready. Install a repeating, automatic transfer from $100 from the family savings into the coupons/money account for every single paycheck course (biweekly or monthly). Then you can adjust it matter as required.

Save money currency (towards the notice-development): This could search counterintuitive, however you must spend more on the training and you will expertise innovation. I just like the immigrants don’t do that enough and it is holding back the capability to increase money (especially not enough mellow experiences). Our company is in the a different country in addition to rules are different, therefore you need in order to adjust appropriately.

That clear step: Remark your own current abilities comment, or set-up a bit with your director to inquire about all of them what you are able do better otherwise exactly what mellow experiences carry out make you invaluable into the people.

Imagine a lot of time-label + Purchase smartly: Realize it is not a race however, a race. You’ll have a much most readily useful effect because of the perhaps not applying for a much better-than-average come back fee, but saving a better than simply mediocre savings percentage.

You to definitely obvious action: Understand one or the after the courses: The tiny Book away from Sound judgment Expenses by Jack Bogle The new Mindset of cash by Morgan Housel The newest Billionaire Next door by Thomas J. Stanley

Handling an expert: An effective CPA is great to own, but I additionally recommend handling a financial planner who’s in a position to book your finances keeping in mind the charge challenges and you may wants.

That clear step: Reach for a free visit! I focus on immigrants with the an H-1B who don’t need their job and you will money to handle the lifestyle and you can immigration. I’m able to help you plan for larger sales such as the EB-5. Let me reveal a link to publication big date with me.

This new EB-5 charge is a common opportinity for H-1B proprietors to begin with the change into the long lasting abode about All of us. Although not, transitioning towards so it charge demands cautious monetary planning and you will research. For additional information on the new EB-5 charge, the way the system works, and also to find out about all you have to start, visit the Western Immigrant Trader Alliance’s resource collection to have prospective EB-5 investors.