Maryland mommy-to-end up being reveals road to versatility away from education loan loans

- Statements

Cost of Biden’s student loan bailout expected to be more expensive than simply $step one trillion

Chairman of one’s Heart getting Revitalizing The usa Russ Vought issues claims by Biden government that education loan bailout is paid off to have.

An early on Maryland woman who has just ordered a home along with her partner because they get ready for the latest beginning of the earliest child are proud you to she developed the monetary acumen to pay off their own student education loans entirely – whatever the path you to definitely anyone else is generally getting.

Found in the Washington, D.C., region city, Micah (just who asked you to their own last label never be made use of) really works while the a builder regarding economic functions world. Inside the an interview, she advised Fox Reports Digital you to she will often be pleased with their fulfillment off repaying a whopping $120,000 within the student loan personal debt – hence she know going in it absolutely was their own obligation to accomplish this.

“To the monetary independence of obtaining paid off my personal education loan obligations, I can work on most other lifestyle desires,” said Micah.

She additional out of their loan, “I thought i’d result in the go to pay it back since the I simply failed to wanted some thing growing more than my head when it comes regarding what if?’ in the future. I wanted to expend it well and start to become out-of one to condition.” She asserted that using this type of appear “satisfaction” having their own.

The debt she sustained earlier had their because of college or university (College off Ca, Berkeley) as well as graduate school (Columbia University College out of Societal Operate in Nyc), she told you.

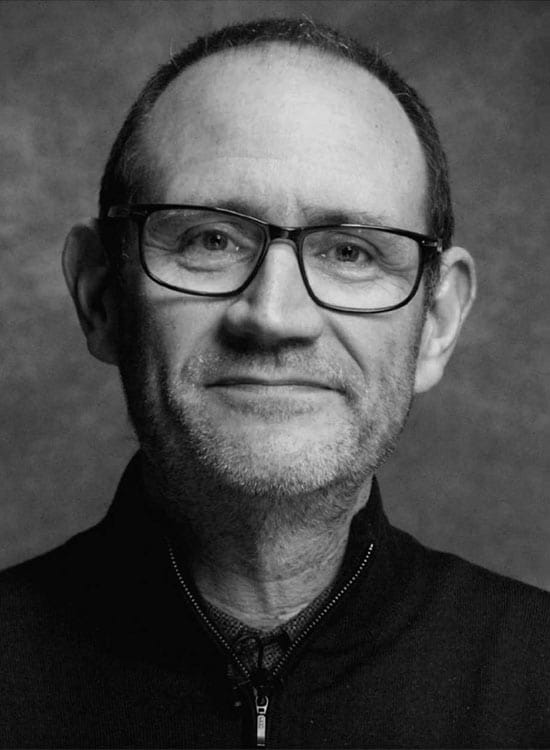

Micah from Maryland repaid their particular college or university and you can graduate university financing totaling $120,000 – now she along with her spouse expect its basic youngster. “I am able to manage most other existence desires,” she said regarding the delivering university loans about their particular. (Fox Reports Electronic)

Their own bring-costs attitude and you will sense of personal duty into the paying off her financial obligation was distinguished considering the Biden administration’s previous statement that it carry out “forgive” some student loan debt to have tens away from hundreds of thousands regarding consumers across the country.

New management, as part of it education loan handout plan, together with told you it can stop mortgage payment loans on the others on the calendar year.

Micah said she realized prior to their own first 12 months regarding school, when she try 17 years of age, you to she would incur new economic burden regarding buying her degree.

However, last week, the newest nonpartisan Congressional Funds Office said the applying will definitely cost regarding the $400 mil along the second three decades – whilst the fresh Light Household said this new CBO’s estimate of your $21 million the master plan will definitely cost within its first 12 months alone is leaner than new administration 1st asked.

With little to no fanfare, new administration has just scaled straight back the brand new qualification criteria to own beginner debt settlement. Now, borrowers with finance secured from the national however, kept of the private lenders commonly qualified proceed the link to receive financial obligation cancelation, according to Training Service.

Meanwhile, the nation’s federal student debt is topping $1.6 trillion after ballooning for years – while the national debt, according to the Treasury Department, is currently within $29.eight trillion.

Has worked step three jobs to invest their own method through college

Micah told you she understood even before their unique first year regarding college or university, whenever she are 17 years old, that she would incur the newest monetary burden from investing in her very own college degree.

She grew up in just one-parent domestic, she told Fox Development Digital, and you can in the beginning, prior to their freshman season out of school regarding the slide out of 2007, their own mommy seated their particular down and you may talked to help you her towards costs inside.