Prepayment punishment try a phrase i tune in to will, but how much will we truly know regarding it? In this article we shall simply take a deep plunge into the meaning of prepayment charges and give you a simple ways to find the prices.

What is actually a great Prepayment Punishment?

Good prepayment punishment, also known as prepay, is actually a clause inside a home loan offer you to says whether your mortgage is actually paid off inside a certain time period a penalty would-be examined.

Which term can be regarded as a contract anywhere between a debtor and you can a bank otherwise lending company one to controls what the borrower is actually allowed to repay and you can whenmonly, really mortgage brokers enable it to be consumers to settle as much as 20% of the loan equilibrium each year.

Paying off a home loan early can take place in several suggests. Selling a house is one way to repay the loan entirely and you will typically, the best.

not, you may want to choose refinance your home loan, and therefore you are efficiently paying the initial mortgage by the substitution they with a brand new mortgage contract, otherwise, you can also hit the prepayment penalty by creating a one-lump commission exceeding this new 20% mark in a single seasons, too.

Brand of Prepayment Penalties

There are two style of prepayment punishment: soft prepayment punishment and you may difficult prepayment charges. A soft prepayment punishment allows a debtor to offer their property at any time in the place of punishment, however if they choose to refinance the mortgage, they will be susceptible to an effective prepayment penalty.

A challenging prepayment penalty is the difficult of the two where a good prepayment penalty is actually awarded whether or not a borrower chooses to sell their residence or refinance the home loan. These types of penalty provides the borrower no accessibility to evading an excellent prepayment punishment if they would be to promote their residence quickly immediately after obtaining the financial.

Prepayment Penalty Truth

You are thinking about, So why do banking companies otherwise mortgage brokers provides prepayment charges? The clear answer is rather simple… Prepayment charges manufactured to safeguard lenders and traders that depend towards the many years of worthwhile repayments to help make a return.

As to why Loan providers Play with Prepayment Charges

Whenever fund is repaid quickly, whether or not by the a great refinance or sales, less of your budget than just originally anticipated will be generated. Prepayment penalties was basically a means for those with an intention during the a borrower’s financial so it get something right back, it doesn’t matter what much time the mortgage was kept just before getting reduced of.

Banks otherwise mortgage lenders check out here additionally use prepayment penalties as a way to entice customers which have reasonable costs if you’re securing within payouts. The concept is that finance companies perform straight down its costs actually ever-so-some but consult you to customers signal a binding agreement to invest an excellent penalty when they paid back the mortgage during the a set several months of your time, usually between about three and you will 5 years.

Will cost you from a beneficial Prepayment Penalty

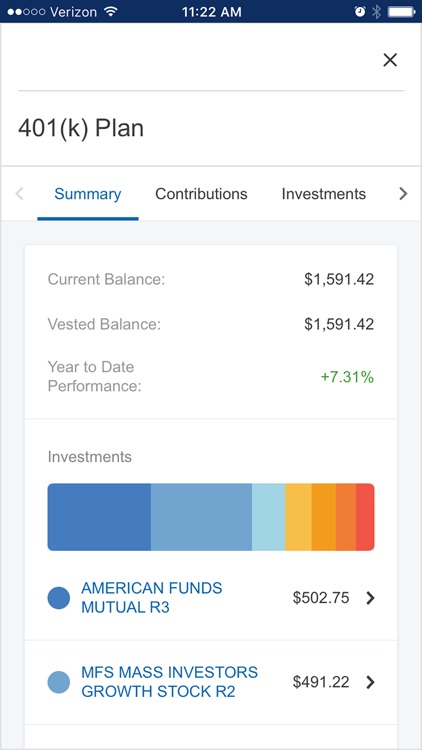

So what does an effective prepayment penalty pricing? Although it can differ based on for every single mortgage bargain, a great prepayment punishment is often 80% off half a year notice since financial usually lets the latest borrower to repay 20% of your own mortgage equilibrium on a yearly basis.

The six months notice is the notice-merely portion of the homeloan payment the latest debtor secured after they took from mortgage. Such as, if the a borrower provides a home loan rate off 6.5% on the a $five-hundred,000 amount borrowed, their attention-simply fee is released to $dos, monthly.

Proliferate one to because of the 6 months, or take 80% of the full to get the prepayment penalty cost of $thirteen,000. This new prepayment penalty is typically put anywhere between dos% and you will cuatro% of complete loan.

How to locate Punishment Advice

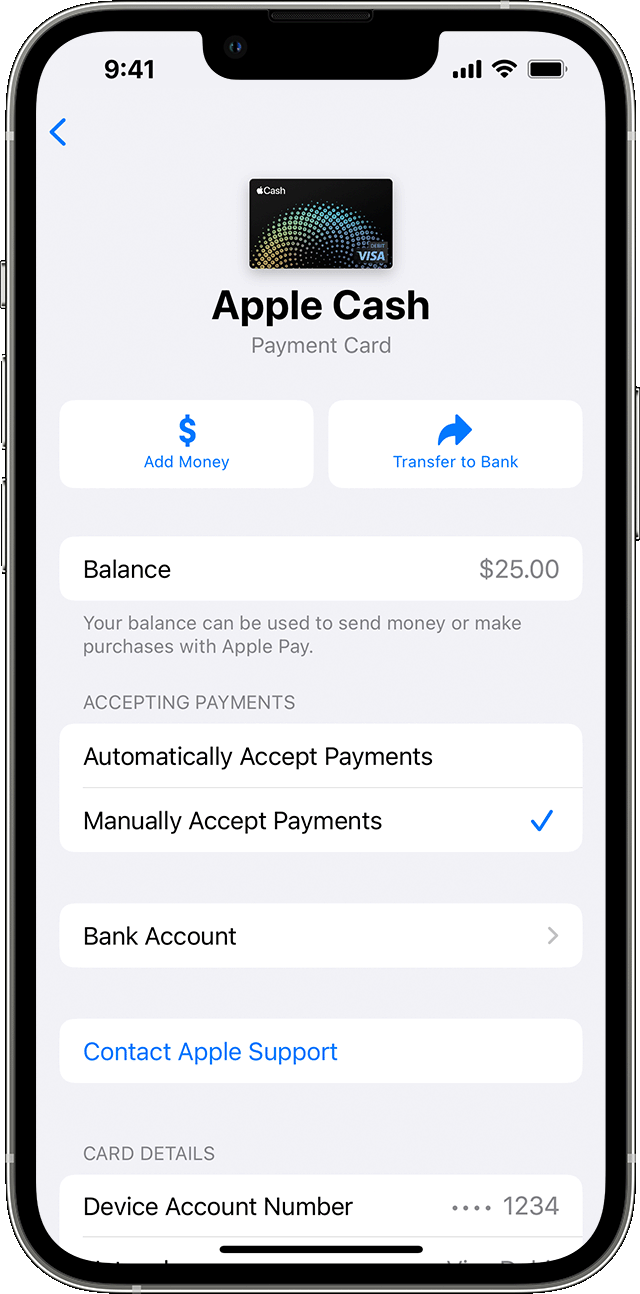

The most important thing having a debtor to check on its deal or financial files to decide whether they have an effective prepayment penalty and exactly what that penalty try. Lenders have to reveal prepayment punishment in the course of closure towards a different home loan.

this is available on Prepayment Disclosure or Prepayment Punishment Disclosure data files. By the reading the new small print, a debtor will be able to know if brand new prepayment punishment is fixed otherwise according to a sliding-scale one to decreases the extended the financing try kept. Without any disclosures, like charges can not be implemented.

How to avoid Prepayment Charges? Defeasance.

Defeasance try a complicated process to pay-off a commercial a property financing very early. It will be the replacing out-of guarantee for real home equity. As opposed to spending cash for the bank, this option allows the fresh use to replace an alternative dollars moving asset into totally new equity into the loan.

Just like the financing-people expect a certain rate off return from your industrial loan, youre prohibited away from entering defeasance in first couple of ages immediately following their loan’s origination. Learn the particular procedure for defeasance here.