Extremely lenders also have an effective pre-requisite that describes minimal earnings brand new debtor must have to help you be eligible for using the mortgage.

So it may differ that have nations. Some banks have to have the credit individual to possess an income off Dh200,000 per year to have Middle east countries, and also for Us or other regions: $80,000 per year.

Period are limited in comparison to residents from inside the Asia. Really lenders have a pre-requisite you to definitely defines the minimum earnings of the debtor.

Mortgage against property interest rate have been around in the range of 8.seven percent in order to % yearly.

Thus earliest, check if the mortgage interest levels is actually reduced in the nation from house, and in case yes, you might be interested in taking a loan truth be told there and you can after that by using the finance in Asia, such paying down or refinancing the debt.

No matter if if that’s possible, might also have to cause of the expenses on it, for instance the exchange rate, control will set you back and you will property foreclosure will set you back, which we’re going to go through in more detail next when considering dangers in order to refinancing.

Risks to help you refinancing

Be it with regards to credit against debt-100 % free house or refinancing loans till the loan’s identity period ends, all of the types of refinancing is sold with their likelihood of most costs or charges.

Quite often, banking institutions costs a maximum of step 1 % of the loan count sanctioned otherwise INR10,000 (Dh485), almost any are large, while the operating percentage.

Specific lenders may charge 2 % once the prepayment charges. Whenever of late payment of your own equated monthly instalment (EMI), your p obligations enforce as per county statutes.

One of the major risks of refinancing your residence arises from you’ll be able to punishment you may happen as a result of paying your home loan together with your distinctive line of home security credit.

For the majority home loan arrangements there is certainly a provision which enables banking institutions so you can charge you a fee for performing this, and these costs can also be number go into the plenty.

Once the an enthusiastic NRI, this type of will set you back may include paying for a legal professional to be sure you are receiving the very best bargain it is possible to and you can deal with files you might not feel safe or perhaps not in a position to answering aside, loans Woodbury Center CT and lender fees.

Than the amount of money you’re bringing away from your brand-new line of credit, but rescuing thousands eventually is obviously worth taking into consideration.

The entire process of refinancing can also incorporate most fees such as for example domestic financing control payment, what type need to be taken into account particularly when comparing pros of your transfer out-of mortgage from just one to another.

In this instance, because documents is actually authorized by the this new place, a great cheque of an excellent amount addressed into the new financial was awarded so you can foreclose the borrowed funds.

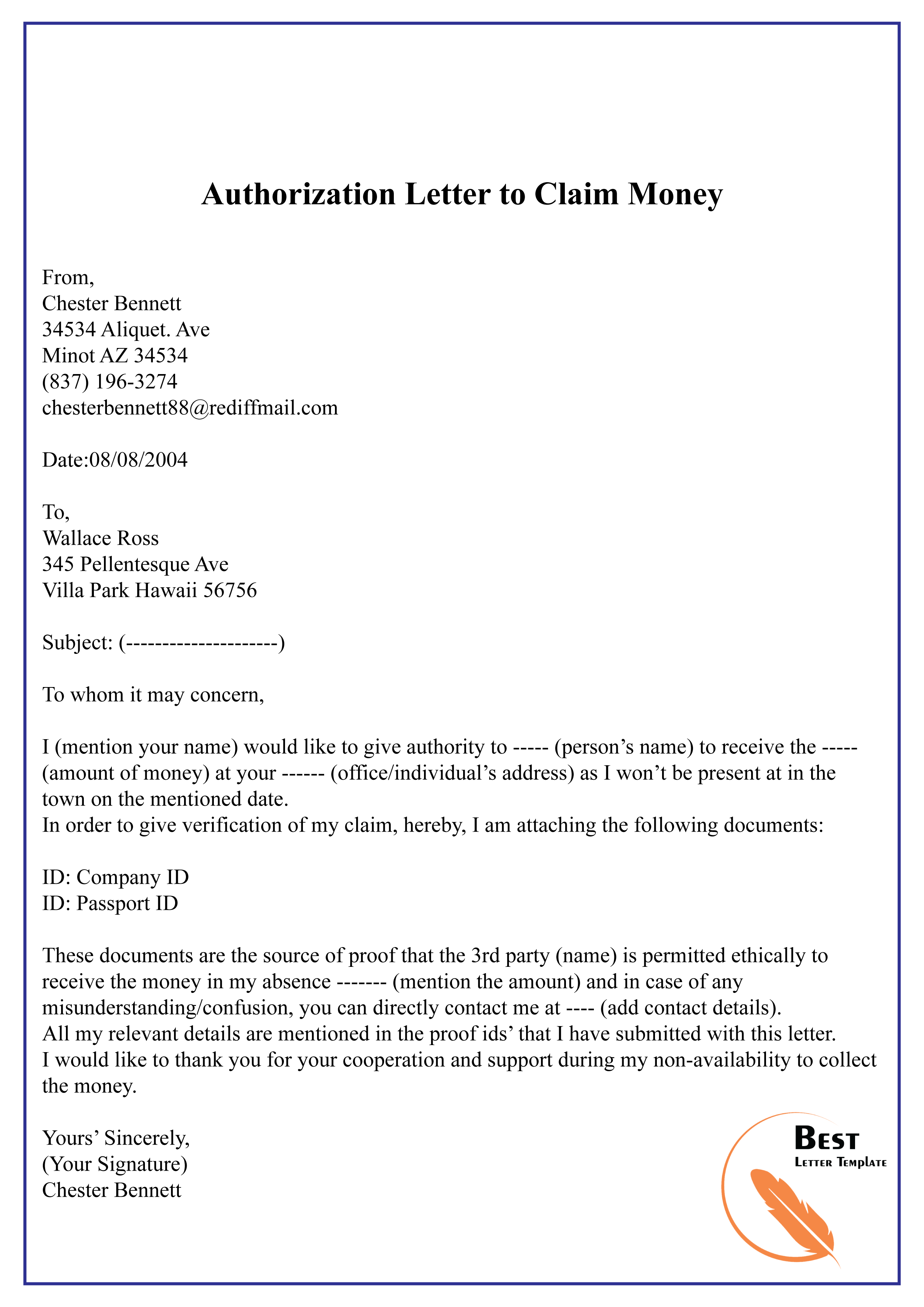

A lot more banking companies throughout the UAE have to give you profit on their established mortgages, in which they slow down the interest rate charged having a one-seasons several months, passageway towards the previous cut in interest rates into the users. The image is utilized having illustrative intentions merely. Image Borrowing: Provided

Given that you will find learn the different facts refinancing is employed let us now get a hold of, how one can go about it.

Checking your own qualification

Today going to a button conditions, that is examining regardless if you are qualified. Really refinance establishment are just be availed if particular standards is fulfilled.

To start with, what’s expected from the really banking companies is the fact minimal quantity of EMIs (otherwise all if you’re refinancing against an obligations-100 % free domestic) being reduced of the customers. Furthermore, the house is preparing to occupy or already filled.