As a homeowner, We usually recite next mantra: which have homeownership appear great obligations-and most of the time, great expense. While you are in the market for a home, it’s easy to score distracted of the charm out-of cosmetic enhancements-the fresh hardwood floors, stainless steel products and stone counter tops- and you will overlook probably high priced but important solutions which you can invariably need at some point.

There are two main sort of expenditures you will need to handle: structured and you can unexpected. Planned expenditures try track-ups that one can cover in advance, like a new rooftop and you will replacement the window. The new unexpected solutions is more difficult to plan for, but you can wind up in the a monetary pickle for many who do not have sufficient money set aside in their mind ahead of time. Even though its unclear in the event that of course, if such problems will occur, doesn’t mean you need to adhere your mind about mud and you can merely hope they will not happen. It might in a number of ability.

My personal homeowner conflict reports

Once i purchased my house for the , Used to do a good number of responsible homebuyers create: I experienced a home evaluation. My personal brand new home introduced this new examination which have traveling colours. Brand new inspector did, but not, notice a few minor facts, plus a beneficial walkout in the basements that would have to be replaced 1 day.

Very, image which. Here I am two years toward getting a homeowner. I’m considering, Hey, becoming a citizen isn’t so incredibly bad. Along with small fixes such as for example color my garage door, I haven’t had one big, pricey snafus to compete with. That most changed whenever i woke up one wintertime day after one of our pleasant Canadian storms and found a couple of ins away from h2o in my basements. The latest ominous eventually your house inspector described had arrived.

The house renovations necessitated on flooding wound up bringing regarding six weeks to complete and you may charging me $25K. They integrated brand new eavestroughs, a retaining wall surface, sidewalk, and you can front-porch tips. Although they prices a pretty cent, they’ve enhanced the value of my personal house a lot of time-identity, plus they have been must make certain that my family won’t flood once more. Very I am happier which i had them complete. (Regardless of if We was not happy from the creating cheques totalling $25K in one year to own fixes.)

A good principle would be to finances off step three% so you’re able to 5% of home’s really worth for these can cost you towards the a yearly base.

How to budget for domestic repair, fixes, and you can problems

If only I could point out that the brand new flood are the only and just fix-associated horror I’ve had to manage, but subsequently We have also needed to take on furnace, sump pump, and dishwasher malfunctions, plus a freak windstorm one to tore shingles from my personal rooftop. This type of debacles instructed me quite a bit, and i also are now able to give my expertise unto you. Below are a few secret maintenance and repair takeaways I have accumulated in my own half a dozen many years once the a citizen.

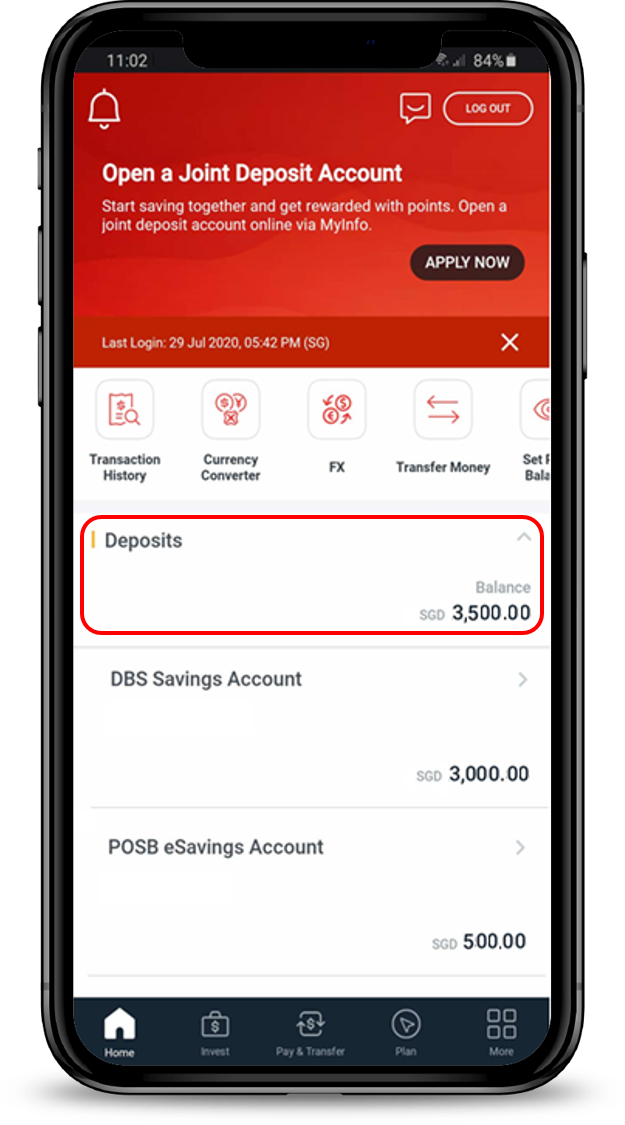

Arranged section of your house loan

Whenever my lender said I will invest to $500K into a house, We crunched the latest wide variety and chose to put a max buy price of $425K having the house alternatively. I became still capable of getting property with it-all back at my like to listing, although lower home loan repayments, homeowners insurance premiums, assets taxation, and you may utility bills gave me some monetary breathing space, with currency left over after the new month going toward repair and resolve.

Estimate how much cash to store according to research by the property value your own https://paydayloanalabama.com/brookwood/ family

Freak incidents out-of nature and unanticipated issues away, typically, you will need to spend mega cash into yet another roof, heating system, screen . . . the list goes on. An excellent rule of thumb is to try to budget out of step 3% so you can 5% of your house’s value for those costs to your an annual basis. To possess a good $500K house, that is around $25K annually.