Sr. Homelending Director/Vp of Conversion process, Flagstar Financial, CDLP

Finding out how much you really can afford is just one of the first steps in our home-to shop for techniques. Of a lot potential real estate buyers value affecting their credit score that have good tough credit eliminate. Luckily for what is a va loan us, there is certainly ways to estimate your own financial qualification without it. Here’s how to find an established imagine having fun with business guidelines.

Procedures to getting Pre-recognized getting home financing

When examining the mortgage alternatives, it’s necessary to guess how much cash you might use depending for the issues like your earnings, credit history, and you will newest expenses. Lenders typically follow particular tips whenever determining whenever you are qualified to receive a home loan and you will estimate an obligations-to-earnings (DTI) ratio to find the maximum home loan amount you can be eligible for. But there are ways to score a primary imagine without impacting your credit rating.

1: Meeting Very first Recommendations

Ahead of plunge towards the number, that loan manager particularly me personally often ask several secret inquiries to help you make you a clear image of everything you you are going to qualify for. Here is the recommendations you’ll need to prepare yourself:

- Understand Their Rating: As we wouldn’t perform a painful borrowing pull during this period, which have a broad idea of your credit score is effective. Increased credit rating generally function a diminished interest and you will most useful loan options.

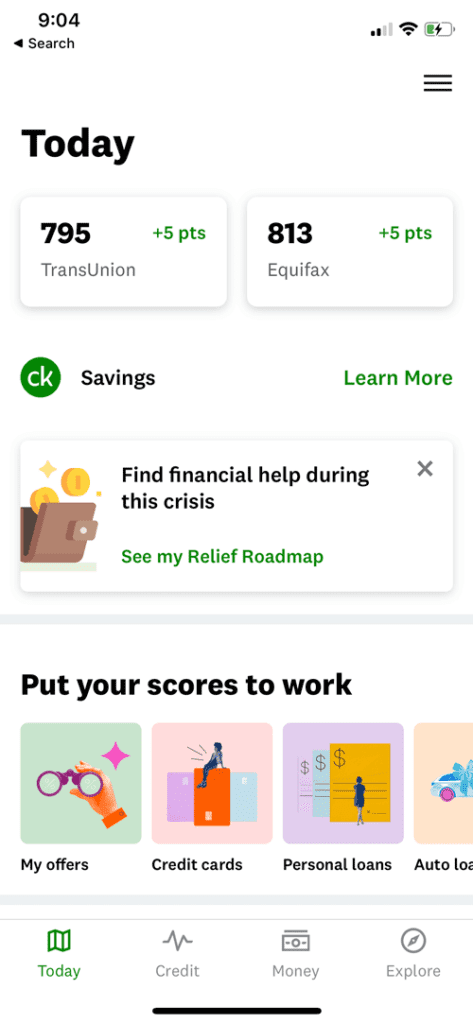

- Professional Suggestion: Fool around with totally free borrowing keeping track of units locate a price of your own score. Try using a rating of at least 700 so you can qualify for really conventional fund. Play with Myfico to really get your scores. Loan providers normally pull the new Equifax Beacon 5.0, Experian Fico II and you can Transunion Fico Classic 04. We remove every step 3 score right after which utilize the center rating. You can get this type of results in place of and come up with a difficult query and for this reason probably lowering your score! I’m never associated with myfico,com.

- Monthly Income: Are all the sources of money, particularly paycheck, incentives, and additional income.

- Month-to-month Expense: Record out costs, in addition to vehicle repayments, mastercard minimums, student loans, and you will child help. It will help us assess your DTI ratio and you will overall financial fitness.

Step 2: Wisdom Delicate Credit score assessment against. Difficult Credit score assessment

In terms of examining your credit for the home loan pre-certification processes, it is important to see the difference in a silky credit score assessment and you may an arduous credit check . One another serve additional purposes and have now type of influences in your borrowing from the bank score.

- No Influence on Credit rating: A softer credit assessment, labeled as an effective “silky query,” doesn’t affect your credit score. It includes an over-all article on your credit history rather than delving into all the information.

- When it’s Utilized: Loan officials have a tendency to fool around with delicate inspections having pre-qualification. It includes a concept of the creditworthiness and you may possible mortgage selection instead establishing an entire software.

- Benefits: Once the a soft query wouldn’t show up on your credit report, its a powerful way to estimate exactly how much you can qualify to possess instead of adversely impacting their get.

- Affect Credit rating: A difficult credit check, otherwise “hard query,” relates to an intensive overview of your credit history, that will briefly decrease your credit score from the a number of points.

- When it is Made use of: Tough checks is presented after you officially make an application for a home loan, charge card, or any other financing. Lenders you want so it more information while making a final credit decision.

Having very first pre-qualification , i encourage you start with a silky credit score assessment to evaluate their possibilities. Immediately following you happen to be ready to move forward and look at belongings, we could go ahead which have a painful credit check in order to conduct the newest loan words.

3: Figuring The debt-to-Money Ratio (DTI)

Perhaps one of the most important components of home loan qualification can be your debt-to-earnings ratio . Loan providers typically like good DTI from forty-five% otherwise lower. We have found a straightforward calculation so you’re able to guess: