Unlike other low- with no-advance payment financial software, there are no special assistance to utilize an enthusiastic FHA home loan. Such, the newest Service regarding Experts Circumstances guarantees the fresh new Virtual assistant mortgage but only to help you members of the brand new armed forces. And USDA mortgage demands buyers getting average or reduced income and also to pick from inside the an eligible outlying city.

Whilst the FHA domestic assessment requirements are stricter than those of old-fashioned mortgage loans, you’ll find fewer special standards. You can utilize FHA mortgage loans regardless of where your home is, that which you would, and you may that which you earn.

This new FHA understands not all homes are move-in the in a position. Especially for earliest-day home buyers looking to buy into cheaper avoid of the fresh housing market. This is exactly why it created the FHA 203(k) rehabilitation financing.

The newest FHA 203(k) financing assists consumers buy good fixer-higher and you will finance the cost or solutions all at once. You could utilize the excess fund so you can modify devices, change floors, exchange a roof, color bedroom, and more.

Once the you happen to be capital the house fixes together with your home loan, you will not have to pay initial when you look at the bucks or take out a special financing. This can save a little money and you will big date when purchasing a more affordable domestic that needs certain try to become livable.

Cons out-of FHA fund

Of course, brand new FHA loan isn’t really as opposed to the drawbacks. Though it has actually novel advantages to have people, there are many something you will need to thought before you choose a keen FHA home loan.

The littlest down-payment you may make to have an FHA financial are step 3.5% of one’s price. Conventional finance go a little all the way down, that have down payment conditions carrying out at only 3%. Which could seem like a little variation personal loans North Dakota online. However, 0.5% from a $250,000 financing is actually $1,250. That might be a deal breaker while you are implementing a good limited income.

FHA mortgage cost (MIP) try mandatory. If one makes a down-payment smaller than ten%, you might be caught having home loan insurance with the longevity of the borrowed funds. If you make an advance payment larger than ten%, you have to pay MIP to possess 11 decades.

Concurrently, a traditional loan’s private home loan insurance policies (PMI) should be canceled once your financing are at 80% loan-to-worth proportion. This basically means, it is away effortlessly once you have centered enough guarantee from the household.

You can also get gone FHA mortgage insurance rates after you’ve paid down the loan balance down to 80% of your own home’s worth. But to take action, might need certainly to re-finance. One to can cost you money and you may begins the loan more right away.

If the mortgage insurance policy is a primary concern for you, you could prefer a low-down-fee antique mortgage in place of a keen FHA loan.

step 3. FHA finance have lower financing limits

The brand new FHA enforces more strict mortgage limitations compared to the almost every other mortgage alternatives. In the most common metropolitan areas, FHA finance is capped in the $ having an individual-family home. In comparison, traditional financing was capped on $ . One another loan designs enable it to be high mortgage limitations in pricey a property areas such as Seattle, San francisco bay area, and Nyc.

While you are shopping from inside the an expensive industry – and you’ve got the financing score to locate recognized to possess a great large loan – you will need a normal or jumbo financing to suit your the latest home pick. A keen FHA mortgage might not be adequate.

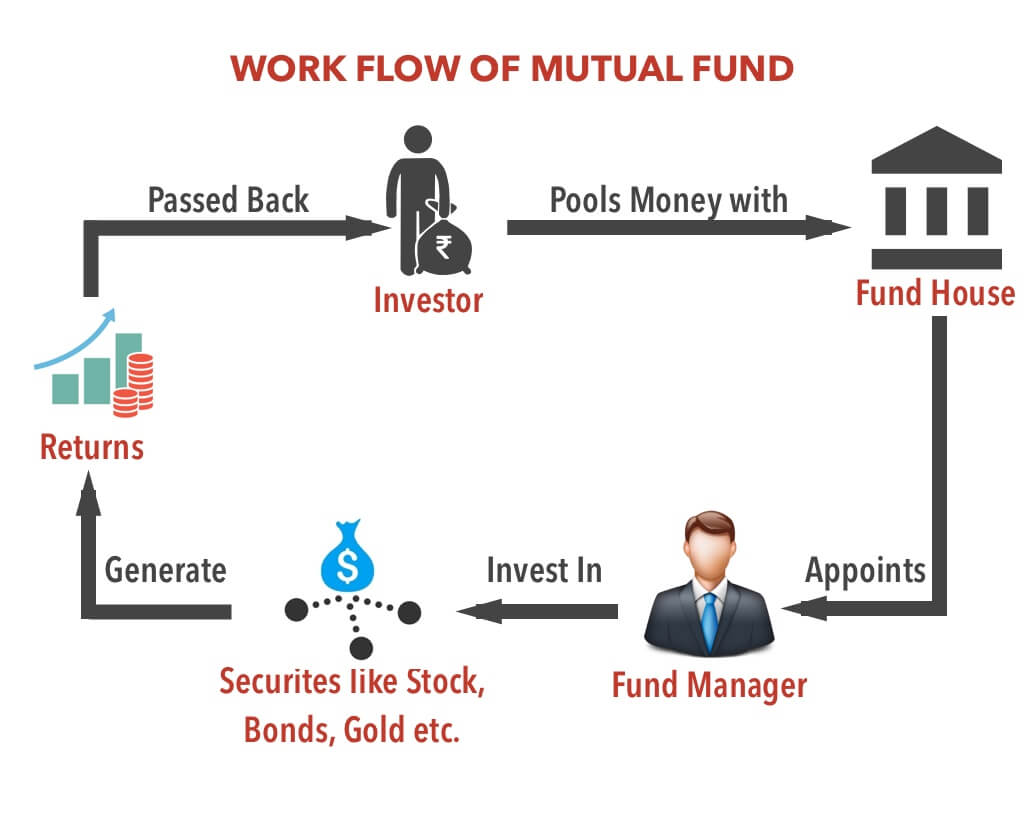

How does this new FHA loan system really works?

The fresh Government Construction Government – generally also known as FHA – falls under new U.S. Institution out of Property and Metropolitan Innovation. One thing to learn is that the FHA is actually an effective mortgage insurance company – perhaps not a lending company. This can be an essential distinction. It means you can purchase an FHA-insured financing from almost any lending company you need.