If not trust me, think about what this offer would look like if one another associations was basically in public areas replaced, investor-owned organizations. Regarding the to possess-finances would, that will be noticed a give-up from manage effectively, a beneficial takeover.

The fresh $step three billion NEFCU intentions to pay no attention after all to your latest owners of brand new VSECU for the ideal to deal with what used to be their credit connection. According to current 2021 balance sheet regarding the requisite Notice, VSECU members possess collected $95.step 3 mil inside the security over the years perhaps not a dime would be settled on it reciprocally to have surrendering command over the borrowing commitment to help you the large and you may a whole lot more lender-instance Vermont rival.

However,, alternatively, the latest proponents of merger was asking the new members of the brand new VSECU to give up control over their borrowing from the bank connection so you’re able to an old opponent free-of-charge. Zero panel out of an investor-had organization perform ever dare strongly recommend such as for instance a proposition to help you its shareholders.

In a sense, the fresh new impending choose towards the takeover out-of VSECU should be seen as a beneficial referendum on way forward for the latest You.S. borrowing commitment course itself.

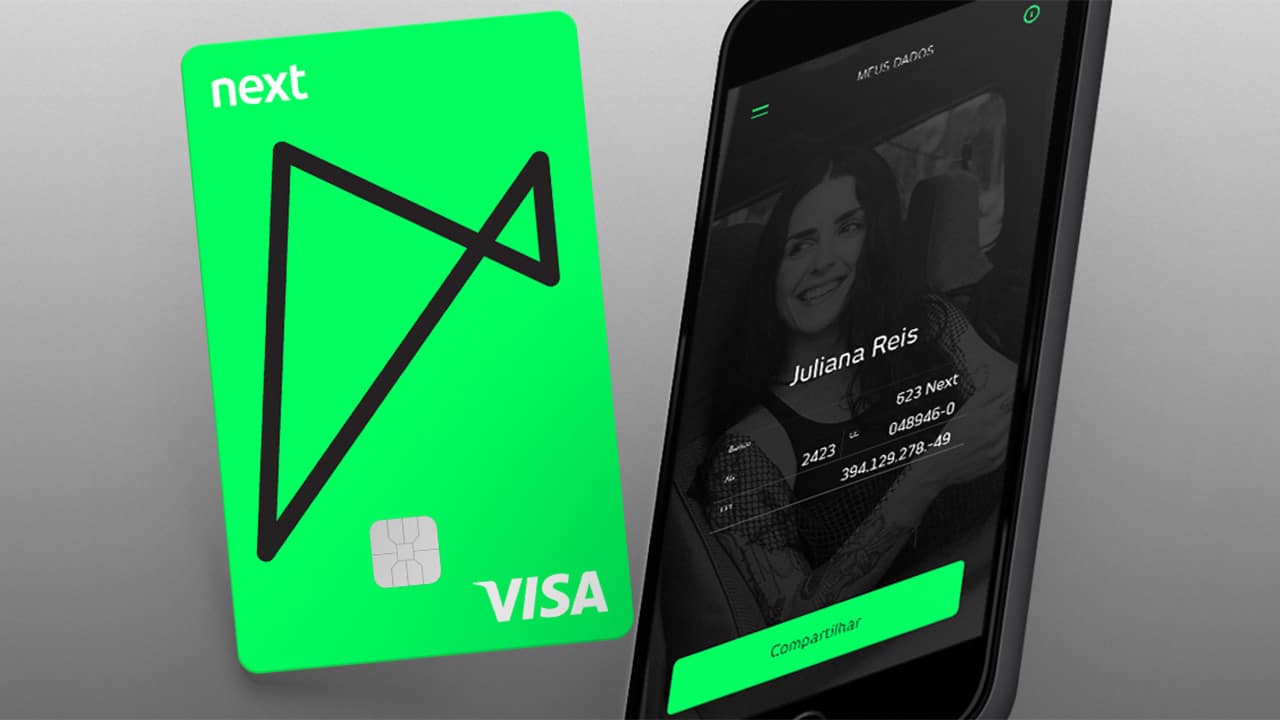

The this that the fresh Ceo was referring try the financing union’s cellular telephone software that enables people to do their banking on the unit they tote around with them within purse and wallets

As i have previously indexed, VSECU shines given that a cards commitment which will take its cooperative identity surely, with its fidelity towards the Collaborative Beliefs the main concept getting democratic member manage. Brand new England Federal Credit Relationship is an alternate credit relationship which is content to run such as for example a bank does.

What makes which so essential to me? After all, I don’t live-in North carolina. We get into five almost every other borrowing from the bank unions and that i even serve to the supervisory committee of a single of them. So i could easily merely sign and become my personal straight back toward VSECU.

We value this because of something said to myself by brand new Chief executive cash advance usa Delta CO officer of borrowing partnership into the whoever supervisory committee I suffice. Whenever i earliest came across the latest Ceo, We informed your exactly how far popular affiliate control, in addition to other half a dozen Cooperative Values, designed to myself since a volunteer borrowing from the bank partnership frontrunner.

Like a payout is effortless sufficient to go of the liquidating a number of the $434 mil when you look at the investment the brand new shared borrowing from the bank connection would have, far above the newest $dos

In response, the newest Ceo removed aside a phone and you will waved they from inside the my personal deal with. The Ceo said a grownup child so it executive’s go-so you can proxy for a typical borrowing from the bank commitment representative. Do you know what she cares about?, expected this new Ceo. It isn’t voting. It is it.

In the event that’s it really is exactly what this comes down to, i quickly stop and therefore would be to people on the borrowing connection direction. Credit unions normally and ought to make an effort to take care of the convenience-permitting tech implemented by mega-banking institutions.

However if borrowing unions can not deliver well worth to people more than and you will outside the convenience one getting-funds loan providers already bring, there is no reason for these to exists.

Put differently, if for example the $step one.step 1 mil North carolina Condition Staff Borrowing Union try not to stand alone, can not be just as simpler just like the a bank when you find yourself giving participants more worthiness and more handle than a concerning-earnings standard bank can also be, following combining having an alternative credit partnership try a waste of go out. Alternatively, new Board out-of VSECU should just spend one $95 mil during the representative guarantee and become over their mortgage portfolio, its deposits, and its particular checking profile to a few super-smoother bank.