You’ve finally discovered the place to find the goals and you are clearly ready and work out an offer. Only 1 problem, you have got to offer your existing home to release bucks to buy the new you to. But a few years back you wouldn’t actually envision and then make a keen bring into the a home that have a-sale backup (this is the have to promote your house first in order to help you proceed with the this new get purchase). Exactly what an improvement a couple of years renders, brand new housing market has gone regarding jalapeno hot so you can iceberg cooler in lot of places within the nation now a merchant was willing to consider any sort of form of promote or deal backup. Just what exactly is it possible you do when you have issues attempting to sell your own bad credit personal loans Minnesota own home in order to change? Well you essentially keeps two options, the conventional connection financing otherwise a house equity line of credit, (or HELOC) shielded against your current household.

The brand new HELOC is the faster cheaper option of this new a couple, particularly if you features many guarantee built up in the your house. This new underwriting procedure shall be handled beforehand and your will set you back are going to be only a few hundred or so bucks (otherwise 100% free) so you’re able to follow the loan. The pace reduced on the line is generally based on the prime rate index +/- a predetermined margin which is considering your credit rating. The key is you have to set up this funding previous so you’re able to list the home for sale or else you will come upon trouble, therefore you should most likely align it funding before starting your own assets search. Commercially the lending company commonly allow you to borrow against any advantage that you individual, as well as your 401(k), however the HELOC could be the trusted otherwise angle the trail of the very least opposition, assuming you have enough guarantee. An element of the drawback is that you can bring all three costs, if you have a first home loan the on your newest household. The 3 money should include the mortgage for the brand new residence also the first mortgage plus the HELOC 2nd home loan with the your house.

Just one Simply click = The present HELOC Rates

A connection financing may be a good product for the reason that your is borrow on the brand new equity in your most recent house whilst you provides likewise indexed it and tend to be attempting to sell it. Nonetheless it can be more pricey total and you will typically offers a great interest which is multiple payment situations more than compared to the new 31 seasons repaired price with an increase of charges recharged towards the financing ranging from dos-cuatro issues. Bridge funds try paid down at the time that the house is in reality marketed and may are nevertheless unlock against a house to have an excellent period of doing 3 years. A key advantageous asset of the bridge mortgage is you can not expected to build monthly premiums on the mortgage because you might to the other sorts of finance, plus a beneficial HELOC, before residence is sold. The bill for the financing, including the compiled desire because of the lender, try paid down during the time the home comes.

From the latest research it appears that this new HELOC ‘s the minimum costly variety of short term funding, provided you need carry-all three repayments and you may due to the fact connection financing is much more pricey, the newest re-percentage is more flexible in this it’s not necessary to care and attention about this until you are able to offer the home, within a while body type. In the long run your own personal finances can get influence which advice carry out feel right for you. In the event the month-to-month money or income is not problematic, you happen to be wise to select the HELOC and when cash is strict therefore do not move as much as around three home loan payments immediately, you’ll be able to fit into a connection financing. Keepin constantly your choices open to come in often guidance is likely smart, thus which have right believe you can also features good HELOC ready for your use beforehand your hunt.

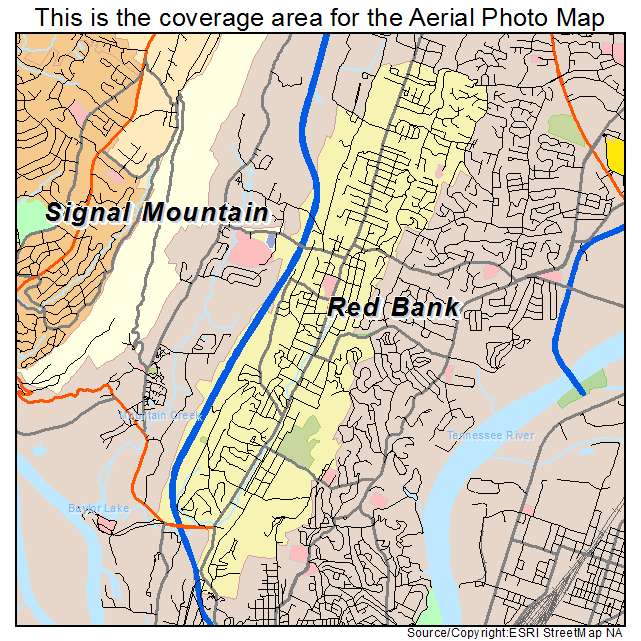

Start with looking for your state

Constantly consult your tax or financial coach concerning your very own private affairs before proceeding which have any bundle and therefore atic effect on yours cash.

Nancy Osborne has already established experience in the borrowed funds company for more than 20 years that is a president away from one another ERATE, where she’s the COO and Progressive Financing Investment, in which she supported once the Chairman. She’s stored a house permits in a lot of states and also obtained both the national Formal Home loan Associate and you may Authoritative Home-based Mortgage Pro designations. Ms. Osborne is additionally a first contributing creator and you may articles creator to own ERATE.