Solutions is property equity mortgage, a personal loan or drinking water advantage covered money, for every single featuring its positives and risks.

You don’t need much choice in terms of expenses taxation. Yet not, you actually have choices on how best to pay them. Composing a check is the one means, but in some instances, it may not be the ideal monetary approach. You’re in a situation in which credit the bucks could possibly get end up being a much better choice.

Deciding on all of the potential possibilities makes it possible to get to your goals, claims David Mook, chief individual banking administrator within You.S. Financial Wide range Administration. This is certainly your situation for those who have an unusually large income tax accountability on account of an enormous nonexempt feel, particularly attempting to sell a pals or a valuable asset one to incurs financing development, or if you pay only a great deal within the taxation annually. The government mandates whenever taxation try due, but one go out will most likely not generate monetary experience for you. Playing with borrowing can supply you with independence and you can command over when to liquidate a secured item or built the money.

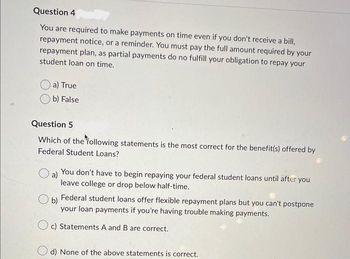

When you’re happy to consider loans to spend your own taxation, here are around three sort of loans you could utilize to invest taxes.

The us government mandates whenever taxation try due, but one to big date may not build financial feel to you. Using borrowing can provide freedom and control https://paydayloanalabama.com/birmingham/ over when to liquidate an asset otherwise make the bucks.

step one. Home guarantee financing to invest taxes

For individuals who own a property otherwise travel assets, you could make use of the security by taking out financing otherwise line of credit to spend fees.

You to downside is that this type of loan takes certain time to create, because bank will need to appraise your home and prepare identity functions. You’ll be able to getting recharged upfront costs that’ll become an appraisal fee, credit report percentage and you can mortgage origination percentage. And you can pricing is higher than the your other available choices.

Shortly after consider advantages and you may drawbacks, Mook says home guarantee financing may be a good choice for some people. Most people are extremely safe which have personal debt to their domestic, he says. Most of us have or has experienced a mortgage. Then it a much warmer alternatives than many other options.

dos. Unsecured loan to spend fees

If not need to place your household up because the guarantee, another option try a personal loan to expend taxation. The advantage to that particular sorts of money are timing. Personal loans are usually less to safe than a property guarantee financing.

Unsecured signature loans is the highest priced solution to acquire, not. As you are not giving the bank one security, the mortgage will always hold a higher interest rate. Personal loans will also have much more constraints, particularly a shorter installment name otherwise smaller credit limit.

Signature loans require also detail by detail economic revelation, such private monetary statements and previous tax returns, states Mook. The fresh new underwriting process is a bit bit more detail by detail for unsecured loans.

step three. Liquids house secured financing mortgage to pay taxes

A third solution to shell out taxation try h2o asset covered funding, that requires pledging their profile away from valuable ties to help you safer an excellent line of credit. The amount you can safer is limited to your matter their portfolio is also service. There are no will cost you otherwise charge having creating a column out-of credit, and this kind of credit also offers no necessary principal repayments. Borrowers are merely necessary to pay the month-to-month notice charge.

This is actually the cheapest means to fix acquire, as interest rates are lower, claims Mook. You could borrow cash and you may pay it back literally if in case need. If you acquire $fifty,000, such as for instance, you’ll be able to pay just the attention towards $50,000 provided it’s the. It’s not necessary to pay the $fifty,000 right back up until you are in a position, of course, if there’s not a drop in the industry that triggers an effective margin telephone call.

Investment your goverment tax bill may help you prevent creating another type of nonexempt feel, for instance the money growth you bear whenever offering a sellable shelter who may have liked when you look at the value. The profile may also build quicker versus focus you’re going to be recharged, making the cost of focus an even more attractive solution.

Liquid advantage protected investment is also the fastest types of borrowing from the bank. A column could be used in place in just days. I give men and women to buy them put up really just before day, due to the fact then it is a call in order to borrow funds and you also may have currency a similar big date, says Mook.

This new downside for it sorts of loan would be the fact its tied to the market, that’s unpredictable. Should your value of new ties utilized because the security falls less than a particular endurance, you may have to guarantee even more ties or lower the brand new mortgage. If not, the lending company you will definitely offer some or all the securities.

Plan Income tax Big date from the seeing your own income tax coach and you will economic elite to know your income tax responsibility and you may threats and also to create plans to possess meeting all of them in a manner that most closely fits debt needs. Credit money is an individual monetary equipment to possess investing your own taxation, and in the end the choice is perfectly up to your. Using one ones about three type of funds to pay off fees can make feel for you in 2010, otherwise as time goes by afterwards.