He including failed to understand how tough it could be to keep in the terms of brand new bargain, since the guy didn’t read how much works loans Evergreen AL our home would need. There isn’t any demands you to a property inspector go through the family ahead of a binding agreement-for-action contract is actually finalized. Whenever Harbour told him he must rating insurance policies, he says, the insurance coverage team started delivering your complications with our house you to definitely the guy didn’t have any idea stayed-that document the guy presented myself, such as for example, informed your that his rake panel, which is an item of timber near their eaves, was appearing damage.

And next, Satter said, many of these companies are aggressively emphasizing communities where customers struggle which have borrowing due to previous predatory financing means, such as those one to supported the latest subprime-financial crisis

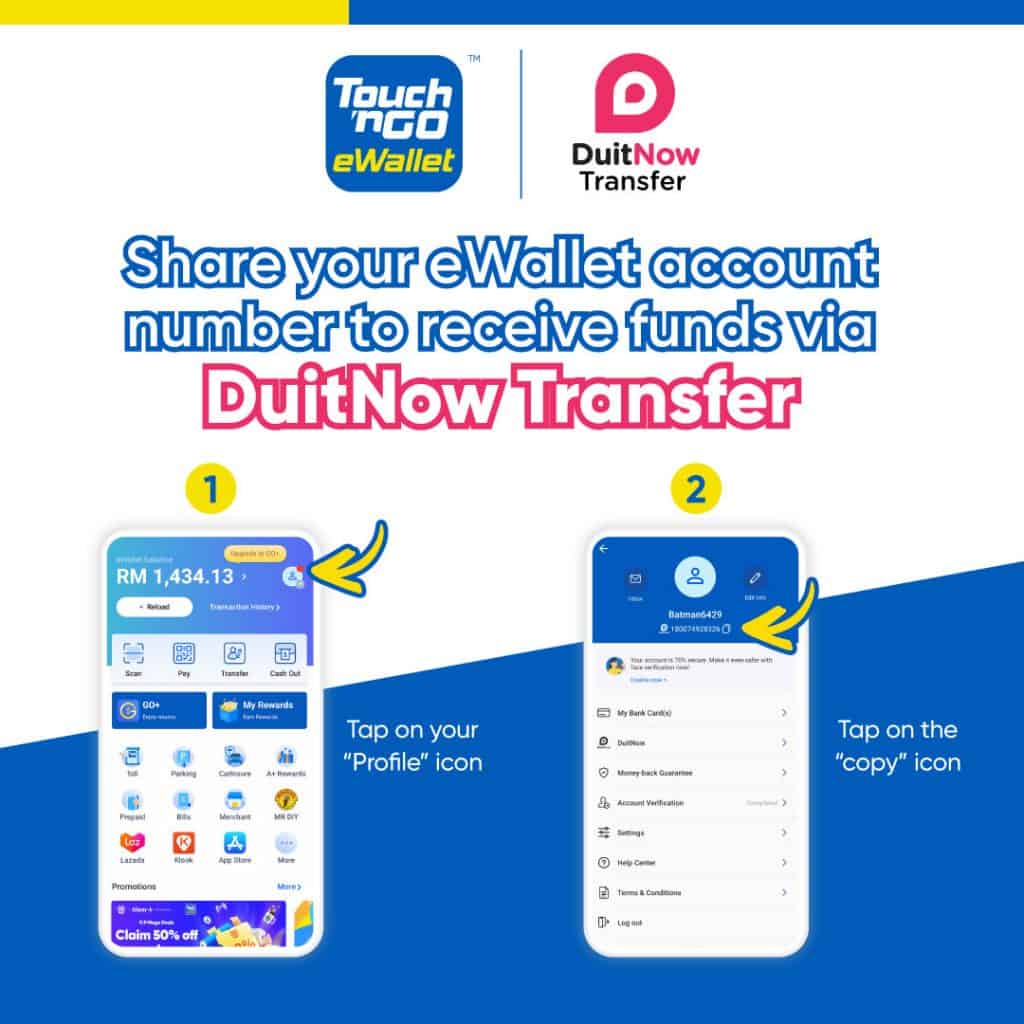

That it map, as part of the Legal Services issue, suggests the new racial constitution of the areas in which Harbour attributes are based in you to Atlanta condition. (Atlanta Legal Services People)

Nothing is naturally incorrect with bargain-for-deed preparations, states Satter, whoever father, Mark Satter, helped organize il customers up against the routine about 1950s. It’s still possible for providers who aren’t financial institutions to finance qualities in a good means, she told you. A san francisco bay area begin-upwards entitled Divvy, such as, was research a rental-to-own model for the Ohio and you will Georgia providing you with manage-become customers some equity yourself, even though it default on the costs. But there’s two explanations such price-for-action plans look such as unjust, Satter said. Earliest, the latest home a large number of these firms purchase have been in dreadful condition-of many had been empty for a long time before being purchased, in lieu of the new homes sold to possess offer for action throughout the 1950s, which often ended up being deserted by light homeowners fleeing to the fresh new suburbs. Fixer-uppers allow difficult having carry out-getting consumers to satisfy every terms of their contracts, because properties you need plenty works.

The newest credit uck, allowing banking companies provide subprime financing or other financial products so you’re able to those who otherwise may not have access to lenders

In a few ways, the newest concentration of contract-for-deed services from inside the Ebony areas is actually a scientific outgrowth away from how it happened in the homes boom and bust. Commonly, these things charged exorbitantly large rates and directed African Us citizens. You to analysis found that ranging from 2004 and you can 2007, African People in america was in fact 105 per cent probably be than simply white consumers to help you enjoys higher-pricing mortgages to own home orders, regardless of if managing to possess credit rating or any other risk circumstances. Whenever a few of these some one missing their homes, financial institutions took all of them more. Those who don’t offer at market-often those who work in mainly Dark colored neighborhoods in which those with funding did not have to wade-ended up on profile out-of Fannie mae, which in fact had insured the loan mortgage. (These are so-named REO, otherwise real-estate possessed belongings, given that financial had them shortly after failing continually to promote all of them during the a foreclosure market.) Fannie mae next offered this type of house upwards from the reasonable prices in order to people which planned to have them, like Harbour.

But Court Services alleges you to Harbour’s exposure during the Atlanta’s Dark colored communities is over happenstance. From the choosing to only purchase house away from Fannie mae, the fresh suit says, Harbour ended up with property when you look at the areas one to knowledgeable the greatest amount of foreclosure, which are the exact same groups targeted of the subprime-lenders-teams of color. Possibly the Federal national mortgage association residential property Harbour bought have been in the extremely African American areas, the new lawsuit alleges. The typical racial constitution of one’s census tracts for the Fulton and you will DeKalb counties, in which Harbour ordered, was more than 86 percent Dark colored. Other customers in the same areas you to definitely purchased Federal national mortgage association REO characteristics available in census tracts that have been 71 percent African american, the newest lawsuit states. Harbour plus directed the products it makes within African People in america, the latest suit contends. They failed to field the price-for-deed plans in press, for the broadcast, or on tv during the Atlanta, the fresh new suit says. Instead, Harbour set-up cues in Ebony areas and you will gave referral bonuses, a habit which, new lawsuit alleges, designed it was primarily African Americans exactly who been aware of Harbour’s promote.