nine. Government Lender Home loan: Federal Lender will bring mortgage brokers on rates which range from 8.80% per year to own financing around ?fifteen crores and tenures as high as 30 years. Their home mortgage products range from the Government Housing Loan and you may Area Buy Financing for buying property having home-based intentions.

ten. Bajaj Housing Financing Financial: Bajaj Housing Funds has the benefit of home loans at rates of interest ranging from 8.50% per year to have loan quantities of as much as ninety% of property’s worth and you may tenures all the way to three decades. Their residence mortgage things become regular mortgage brokers, official finance to possess doctors, top-up financing, and you can financial equilibrium import establishment.

While you are interest levels is an important reason for choosing an educated home loan, it is equally important to look at the unique has and you may experts supplied by more lenders. Some trick features to search for become:

? Versatile installment selection: Of numerous lenders give you the accessibility to choosing repayment tenures, making limited prepayments, if you don’t skipping EMIs not as much as particular situations.

? Top-upwards financing: Certain financial institutions create consumers so you’re able to use more fund (top-up finance) facing their current home loans, which is useful home improvements or any other expenditures.

? Equilibrium import facility: This particular feature allows individuals so you’re able to import the current financial of one to lender to another, tend to at a lowered rate of interest otherwise with greatest terms.

? Special-interest prices or discounts: Of several lenders bring discount rates of interest or concessions to possess certain groups away from borrowers, particularly women, elderly people, or first-time homebuyers.

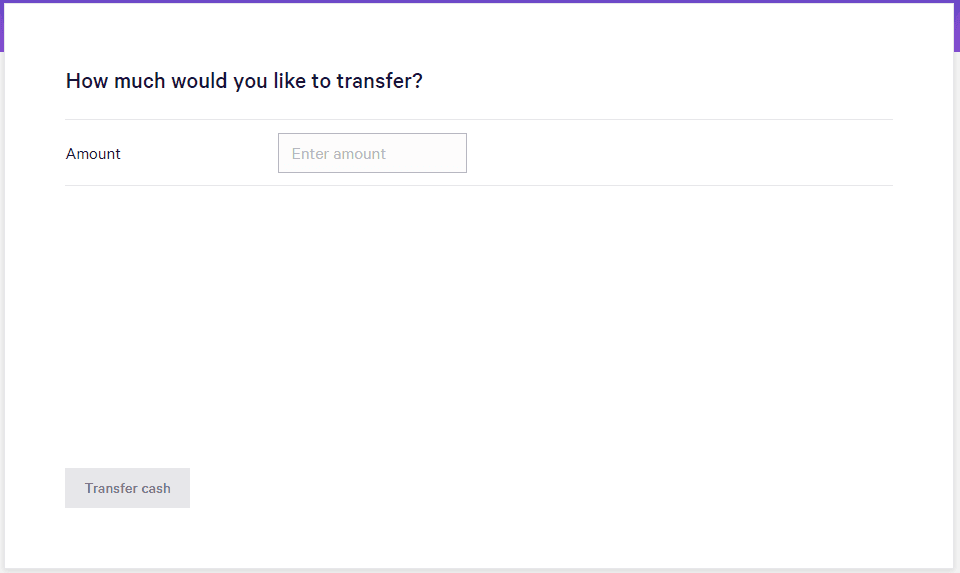

? On the internet membership administration: Banking institutions try even more bringing electronic networks and you may mobile apps for consumers to handle their house mortgage account conveniently.

Different kinds of Lenders inside India

Loan providers when you look at the Asia offer all types of lenders in order to accommodate so you can diverse borrower demands and you will choices. A few of the well-known types tend to be:

? Normal mortgage brokers: These represent the standard mortgage brokers provided by finance companies and you may economic organizations to purchase properties.

? Home expansion fund: Similar to do it yourself financing, these types of finance developed to possess expanding otherwise adding new build in order to a current domestic.

? Patch money: This type of finance are provided for buying a plot of land, generally speaking to create real estate later.

? NRI lenders: Speaking of geared to Low-Citizen Indians (NRIs) thinking of buying homes inside Asia, will having certain eligibility requirements and documents criteria.

? Pradhan Mantri Awas YoAY) lenders: Talking about authorities-supported lenders offered beneath the PMAY plan, which will promote reasonable construction to help you economically weakened chapters of area.

Tricks for Choosing the right Home loan in the Asia

With several financial options, selecting the most suitable it’s possible to getting daunting. Here are some ideas so you can make an informed choice:

? Evaluate your debts: See your revenue, existing obligations, and you will installment ability to influence the right loan amount and EMI you could potentially conveniently pay for.

? Consider the interest: While a lowered interest rate may seem glamorous, additional factors for example operating charge, prepayment charges, therefore the overall cost of advance america personal loans in Columbus your own loan more than its tenure would be to additionally be sensed.

? Understand the cost freedom: Find mortgage brokers that offer liberty out-of fees period, limited prepayments, additionally the capacity to switch ranging from repaired and you can drifting interest levels.

? Compare lenders: Don’t maximum you to ultimately just one lenderpare the products away from several banking companies and you will financial institutions to discover the best price that fits your circumstances and you will funds.

? Have a look at eligibility conditions: To increase your chances of financing recognition, always meet the lender’s eligibility criteria, for example minimum earnings standards, ages limits, and you can credit rating thresholds.