Borrowing from the bank Choices for Ontario Property owners

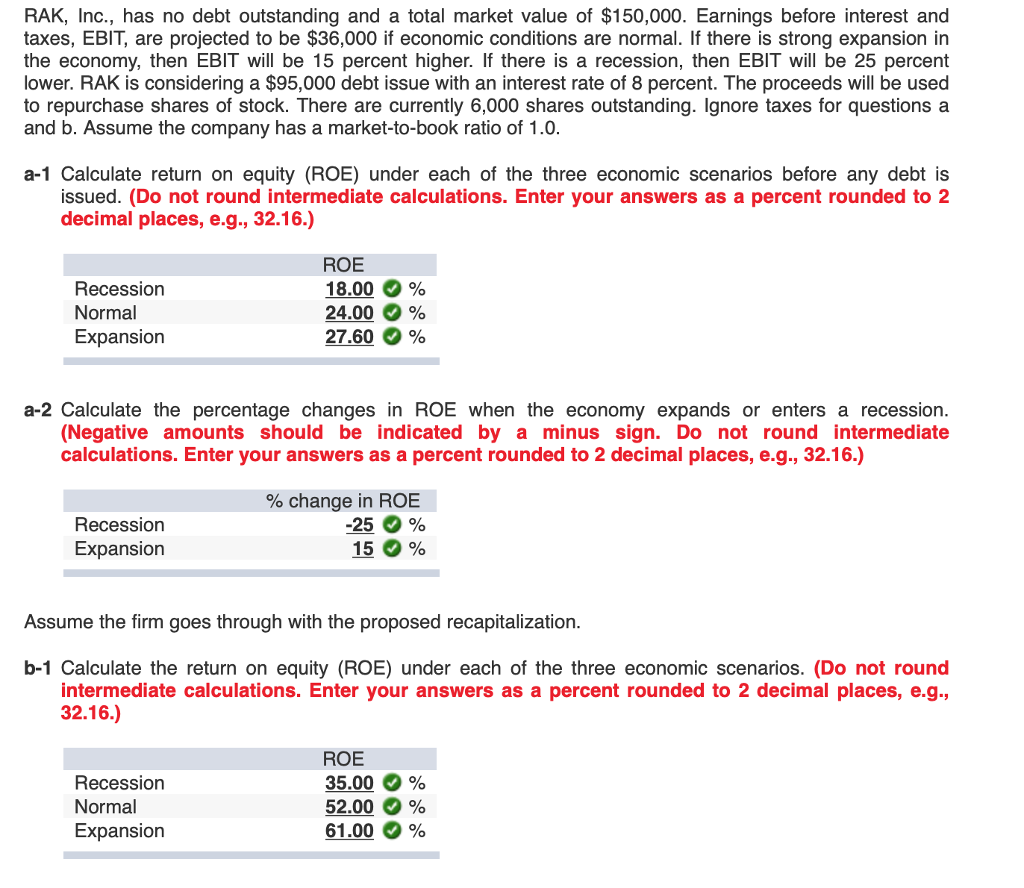

While most may believe one to banks depict the actual only real approach to next mortgage resource, there are many more well-depending lending products to own established Ontario homeowners. Regarding the financial globe, lenders was classified towards the about three greater groups. These firms have been called A beneficial, B, and you can C loan providers. The latest borrower’s power to meet the certification standards only determines new categories to own home loan money.

A creditors- These businesses will be the banking companies. Financial institutions tend to lay borrowers/residents due to rigorous mortgage be concerned tests and require a credit score with a minimum of 600. Loan providers also like traditional yearly, full-time money, that’s easy to estimate whenever deciding mortgage financing recognition.

B Lenders- These lenders was borrowing from the bank unions and you may believe enterprises. B loan providers require at least credit score away from 550 and you will like conventional, easy-to-assess home income.

C lenders- Individual loan providers are known as C loan providers in the home loan world. It give toward an individual foundation otherwise as an element of a selection of private loan providers, and you can lenders are experts in providing personal 2nd financial financing.

The fresh Standards That every Lenders Work at Should be Boiled Off to:

- Credit

- Money

An element of the conditions that every Ontario loan providers need when determining home loan investment are derived from all round quantity of creditworthiness, standard of home money, and you may reasonable family financial obligation proportion requirements.

If a homeowner cannot meet with the tight criteria of antique lenders, you can find private loan providers created in Ontario that in a position to give second mortgage capital predicated on most other standards. Personal loan providers assess family equity, property value, and you will condition to add brief-label money even with bad credit and you can debt rates.

What’s a home Security Loan Used in?

A home equity loan within the Ontario is an effective and flexible selection for fulfilling their small-name funding and financial objectives, as with any different kind of next home loan. Never remove an additional debt duty particularly a personal loan if you have the option to help you utilize brand new security for the your house to fulfill your small-title monetary demands. Uses may differ and may even is:

What’s the Construction out-of Family Collateral Loans for the Ontario?

What is a house collateral financing? A house equity financing enables you to borrow against their residence’s security, searching a lump sum together with your family given that security.

A house guarantee mortgage can be used for of many motives, including repaying debts and ultizing the cash to have quick financial demands including home augment-ups. A lender usually accept a home equity loan from the examining brand new Loan-To-Worth (LTV), standard of security, and your home’s appraised worth.

An LTV proportion ‘s the percentage of the fresh new property’s value due inside the mortgage loans. When the a citizen have a house worth $1,000,000 having a $500,000 first-mortgage which will be requesting good $250,000 second home loan, the fresh LTV ratio towards requested home loan should be up to 75% of your property’s worth. To discover the low rate of interest, you need financing-to-worth proportion below 65% and you can enough money to cover month-to-month desire repayments. Personal lenders can give an increase between 8% to several%. The lower this new LTV, the higher the pace.

The banks will demand excellent borrowing from the bank and you may often calculate a keen LTV away from generally 95% mortgage to 95% of your appraised worth of your residence. To track down acceptance for a house equity mortgage, you ought to bring good proof of good-sized collateral.

When the less than perfect credit has finalized the doorway to securing property equity financing owing to a lender, a personal lender (C lender) normally negotiate brief-label household guarantee capital according to a recently available assessment of your domestic.

A private bank identifies LTV considering your own home’s collateral. Greater risk due to bad credit or debt limitations LTV to 75%. They’ll be finding:

Financial Cost and you may Fees to own Private Household Collateral Loans

Private home loan cost would-be somewhat greater than its lender alternatives. This applies directly to the fresh new deemed greater risk of one’s financial loan because of poor credit and you will potential highest obligations degrees of the fresh new borrower/resident.

Basically, a private bank fees home financing price between 7% and you may twelve%. A perfect interest will depend on this new homeowner’s novel economic photo. People associated costs generally may include 3% in order to 6% of your own total price of financing. Seeking consolidate debt, remodel, otherwise fund expenditures? Our very own educated mortgage brokers bring smooth navigation. Extend to have assistance.